Asia Database

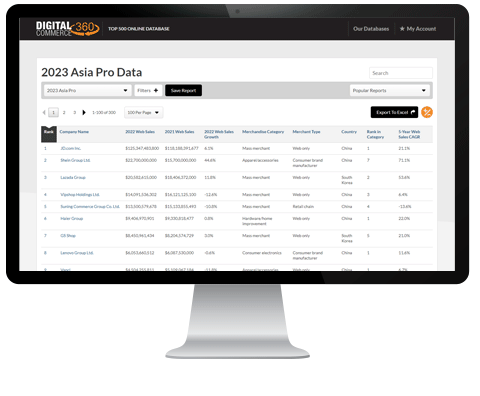

Digital Commerce 360’s Asia Database is a complete ranking and data dive into the leading Asian online retailers, ranked 1-300 by annual web sales.

The leading 300 ecommerce companies in Asia saw online revenue growth slowdown in 2022 to 4.1%—much like the upper echelon in the U.S., Europe and Latin America. Overall, the leading online retailers in Asia collectively grew digital revenue to $353.9 billion in 2022, up from $340.1 billion in 2021.

Purchase access to the 2023 Asia Database to gain insights and explore competitive data, including up to five years of web sales on these retailers that range from $32.7 million to $125.35 billion in annual online sales. Explore the heavy hitters such as Chinese consumer brand manufacturer Lenovo Group Ltd. and South Korean mass merchant GS Shop.

Part of the most comprehensive data we’ve compiled to date, our expert research team surveyed and interviewed retailers, dug into public filings, studied website traffic data and analyzed key trends to identify all the significant players selling to Asian consumers.

Published July 2023*

*While we formally launch new editions of each database product annually, we make necessary updates to our rankings and data throughout the year.

ABOUT OUR DATABASES

Whether you’re searching for your next ecommerce solutions client, acquisition, investment opportunity, or simply researching new competitors, the Asia Database is a global ecommerce prospector’s best tool.

WHAT’S INCLUDED

Ranking of Asia’s Top 300 Online Retailers

(VIEW SAMPLE PROFILE) (VIEW SAMPLE PROFILE) |

Financial & Performance Metrics

- Ranking of Asia’s Top 300 Online Retailers by 2022 web sales

- 1 Year Web Sales Ranges (5 Years Exact Included in Pro Database)

- Company Information (Merchant Type, Primary Merchandise Category, Corporate Address & Year Launched)

- Key Performance Metrics (Growth, Average Ticket & Conversion Rate)

- Website Traffic Analysis (Overall Visits & Traffic Share by Device Type and Channel)

- Website Features & Functions

- Shopper Demographics

WHY YOU SHOULD BUY IT

Our 2023 Asia 250 Database is the most up-to-date and accurate financial and performance data that exists on Asian ecommerce, giving you a detailed look at the online retailers at play in the region.

RELATED CONTENT YOU MAY LIKE

Rankings and data on Europe’s 500 leading online retailers

Rankings and data on Latin America’s 250 leading online retailers

Rankings and data on North America’s 1,000 leading online retailers

International Retailer Starter Kit

Basic sales data on the leading online retailers across Europe, Asia and Latin America